Quiet an interesting read... his view on value & investing.

Should take a look.

Thursday, 31 January 2013

Wednesday, 30 January 2013

Value Traps

Came across an interesting article by Dali on value traps, it identifies companies with trading price significantly below its NTA value and the rationale behind them (lack of catalyst).

While many investors knows the term value trap, it is perhaps hard to tell a value share apart from a value trap.

In my short investment life, I've focused on the discovery of value share - those that tick all of Graham's criteria for value. But recent lessons has made me reevaluate my approach in investment.

Here's an excerpt from Buffett's annual letter to investor:

So if value is not the key to a successful portfolio then what is? Investment is not an easy game to play afterall!

Thursday, 17 January 2013

Revisiting YTL Cement privatisation

Summary - this is my rant about how YTLC minority could have gotten a better deal if they've stayed listed & YTLP shareholder shouldn't get too excited about attempt to privatise through share swap

(Dedicated to HNG :P)

----------

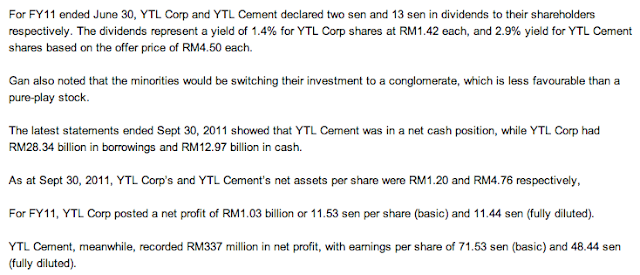

YTL privatisation - is it a good deal for minority? A lot of commentators before me have pointed out it's a raw deal to minority who have invested in a business hoping for a payday when the company is more profitable.

Currently Malaysia is going through a huge construction upswing, with cement sector doing particularly well. What would the effect be if YTLC stay listed? We can look at Lafarge for a comparison.

It's up approximately 48%! YTL's management are not stupid to privatise an overvalued assets, they are among the smartest team of management in Malaysia with their ability to buy distressed asset and turn them around profitably.

Much of YTL's cash horde of RM 12B (I believe) lies in YTLP. The estimated figure is $10B out of the RM12B sits at the subsidiary level. They could get to it by doing an intercompany loan (look at L&G), payout a dividend, or privatise YTLP then payout a dividend.

Looking at their history with YTLC - in hoarding cash then privatising it without EGM - I hope they will keep YTLP listed and increase the payout. But I can only speculate.

(Dedicated to HNG :P)

----------

YTL privatisation - is it a good deal for minority? A lot of commentators before me have pointed out it's a raw deal to minority who have invested in a business hoping for a payday when the company is more profitable.

Intrinsic value

I am of the opinion that shareholder gets better intrinsic value by holding a pure-play cement counter rather than holding a conglomerate counter like YTL. If I want to hold YTL, I would have went out to buy their shares - no thanks for forcing me to be a shareholder. In YTLP's case, I say no thanks to any privatisation attempt through share swap with no acquisition premium. YTLP's underlying holding is far superior than YTL's mix pot of assets.Earning growth

As noted in my last post, YTLC's earning is up 41% is its latest announced quarter. No doubt by privatising it, YTL have managed to plug the cashflow leakage to minority shareholder, thereby maximising the cashflow for its own benefit. Assuming the same PE multiples, the increase bottomline will directly mean a better underlying share price. Those YTLC shareholder that bought in at over RM5 would know.Currently Malaysia is going through a huge construction upswing, with cement sector doing particularly well. What would the effect be if YTLC stay listed? We can look at Lafarge for a comparison.

It's up approximately 48%! YTL's management are not stupid to privatise an overvalued assets, they are among the smartest team of management in Malaysia with their ability to buy distressed asset and turn them around profitably.

Dividend payout?

Althought YTLP and YTL is paying the same absolute dividend at the moment - YTLP's cashflow generation rate allows them to pay a far higher dividend then what YTL is capable of. This is by virtue of their current cash horde of RM10B - along with their cash generation ability. The lowering of dividend is a conscious management decision and not forced upon them by any external difficulty.Much of YTL's cash horde of RM 12B (I believe) lies in YTLP. The estimated figure is $10B out of the RM12B sits at the subsidiary level. They could get to it by doing an intercompany loan (look at L&G), payout a dividend, or privatise YTLP then payout a dividend.

Looking at their history with YTLC - in hoarding cash then privatising it without EGM - I hope they will keep YTLP listed and increase the payout. But I can only speculate.

Likelihood of privatisation & EGM

Unlike the YTLC privatisation where a waiver of EGM requirement allows them to carry out the share swap it is extremely unlikely for a similar situation to happen in YTLP's case.

YTL despite its frequent rhetoric on its desire to privatise YTLP has recently made a massive grant of WB to YTL's shareholder - my initial suspicion was a privatisation attempt. But Felicity of Intellecpoint has pointed out it's extremely unlikely for them to give out WB at a discount then buy it back at a premium - just doesn't make sense.

In the event that they do attempt to privatise, waiver is unlikely to be given as shares required to be issued will exceed the 10% threshold. But this only applies at YTL level - as YTL shareholder, of course I will support the deal. YTLP's EGM situation is more murky. I am not too sure what's the effect of the mandatory takeover code on such privatisation attempt - if there's anyone that's an expert do chirp in.

I would speculate that an attempt to privatise will be conducted through another private vehicle not part of YTL's group of company. Simply because despite the value of YTLP - it doesn't make sense for YTL to give out discounted warrant and then purchase it back at a premium.

Makes more sense to give out discounted warrant and allow a private party to purchase it back in the market at the depressed pricing.

Excerpt of news article on privatisation of YTLC

Wednesday, 16 January 2013

YTL Corp Berhad - Massive buyback program

Summary: YTL share price have been well supported through a massive share buyback program amounting to over RM600 million over the past 12 months.

However underlying earning have also improved, primarily due to favourable results in its Cement segment. Quarterly earnings at YTLC increased by approximately 41% or RM 50 mil.

--------

YTL Corp's share have been on a tear lately. The price shot up from its trading range of around RM 1.4 to RM1.6 to eventually trade above RM 2 before currently trading at RM1.80. Representing an appreciation of almost 29% (40 cents up from 1.40).

It's currently trading at approximately 12x forward PE (based on annualised Q1 earning) or 15x historic PE.

If you review their P&L, you won't find anything extraordinary to warrant these price movement I reckon.. net income went up from 1.03B to 1.18B - roughly a 10% increase.

Its EPS and DPS figure shows improvement but is it really the cause of the appreciation??

EPS went up from 0.11 to 0.12 cents in last 12 months - about 9% increase.

YTL Cement

Since their delisting in April 2012 after privatisation, the YTL Cement unit have achieved a 41% jump in quarterly profit. I wonder what would the price be if they were still traded. This result announcement was around June/August 2012.. YTL's price declined from RM2 since this result announcement.

Based on segmented result at 30/Sept 2012 - it seems that the biggest contribution to the net income increase is YTL Cement and management service.

MASSIVE buybacks

In the past month alone YTL repurchased approximately 15.4M shares amounting to approximately RM 29M through share buybacks.

Since January 2012 - their total buybacks amount to 361,850,700 units.

(Looking at 15 Jan 2012 buyback announcement and 16 Jan 2013 buyback announcement - taking into consideration distribution of treasury shares in July 2012 of 647M shares)

The cash outflow from buybacks is pretty significant, in FY 2012 they spent over RM 500 M in buybacks. More than on distribution of dividends.

Given that they have continued repurchasing shares since its financial year end, I would estimate the total amount spent on repurchase of shares to exceed RM 600 M. Given that the share price movement does not track the result announcement, I would assume this massive buyback is the primary cause of the price increase.

Implication?

YTLP's price is depressed due to a massive supply of discounted WB granted by YTL. If an attempt to privatise YTLP through shareswap as claimed by many analyst, then the minority shareholder of YTLP would be giving up share in a depressed YTLP (with potential catalyst) for a share that's trading 30% higher than its trading range on the back of a massive share buyback scheme.

YTLP - debt, leverage and natural hedging

Summary: High gearing for foreign denominated assets reduced FOREX risk through natural hedging of forex risk, reduces overall asset portfolio risk.

----------------

YTLP has approximately RM23 B of debt as at June 2012 (up front RM21B) in June 2011. Bulk of this increase is due to capital spending at Wessex Water and Yes of approximately RM1.6B and RM897M respectively.

The Wessex capital spending is due to their £1B investment plan between 2010-2015. I am not sure what's the ROI for these investment given the declining segmental profit since 2010.

Debt as natural hedge in oversea investment

Anyway, the bulk of the borrowings lies in Power Seraya and Wessex Water. These borrowing represent approximately RM16B or 69% of total borrowing as at June 2012.

These debt represent 77% and 91% of asset in Power Seraya and Wessex Water.

As highlighted in the past by the management, YTL seek to hedge its FX exposure through foreign denominated borrowing that correspond to the underlying asset currency.

Hence, I think its FX borrowing (at rather low effective rate) acts as a efficient risk management strategy and given the secured nature of the underlying cashflow - investors should not be too worry about its level of gearing.

----------------

YTLP has approximately RM23 B of debt as at June 2012 (up front RM21B) in June 2011. Bulk of this increase is due to capital spending at Wessex Water and Yes of approximately RM1.6B and RM897M respectively.

The Wessex capital spending is due to their £1B investment plan between 2010-2015. I am not sure what's the ROI for these investment given the declining segmental profit since 2010.

Debt as natural hedge in oversea investment

Anyway, the bulk of the borrowings lies in Power Seraya and Wessex Water. These borrowing represent approximately RM16B or 69% of total borrowing as at June 2012.

These debt represent 77% and 91% of asset in Power Seraya and Wessex Water.

As highlighted in the past by the management, YTL seek to hedge its FX exposure through foreign denominated borrowing that correspond to the underlying asset currency.

Hence, I think its FX borrowing (at rather low effective rate) acts as a efficient risk management strategy and given the secured nature of the underlying cashflow - investors should not be too worry about its level of gearing.

Illustration

Currently GBP/MYR is approximately 4.8, it's approximately 6.2 back in 2009 - representing a weakening of 22.5% over 4 years.

Assets held under Wessex water was RM11.5B as at June 2011 or approximately GBP2.4B.

GBP2.4B @6.2 = RM14.9B

Representing a devaluation of approximately RM3.35B in asset value.

HOWEVER - due to "natural hedging" in the form of GBP denominated debt, the debt has also devalued by 22.5% - reducing the devaluation loss to approximately RM336M.

Saved the shareholder RM3B due to this "high gearing".

Note: Actual figure will differ - but concept is accurate.

Herbalife - update 2

From my initial blog on Dec 28th, the price of HLF went up from approximately USD28.5 to close about USD 46 yesterday. That's a gain of approximately 60% in 17 days.

Although I feel that the company is fundamentally strong, the valuation have bounced back from pre-ackman presentation level.

I will try to lock in some of my gain in the next couple of days..

Although I feel that the company is fundamentally strong, the valuation have bounced back from pre-ackman presentation level.

I will try to lock in some of my gain in the next couple of days..

Friday, 11 January 2013

IGB REIT - abit rich for my taste

Summary: IGB REIT, PB 1.37 PE 25, Yield 4%.

Gardens is one of my favourite KL mall, IGB REIT is up there on the top active counter today - being curious I checked out its valuation.

Gardens is one of my favourite KL mall, IGB REIT is up there on the top active counter today - being curious I checked out its valuation.

Just looked up its quarterly with a 6 month forecast..

Its expected income was annualised to get a valuation computation.

Conclusion: Too rich.

Thursday, 10 January 2013

Al-hadharah Boustead Reit

REIT makes up a really big part of my portfolio. I love the simplicity of the investment that have predictive earning and a stable dividend payout. It's a business I can totally comprehend. You can be part owners of shopping mall, hospital, office buildings, factories, warehouse or whatever. You don't have to deal with the tenants - just collect your "rent".

In Malaysia, I went a different route and chose to invest an oil palm REIT - Boustead REIT back in May 2011.

Boustead REIT is pretty unique, it's got a fixed rent, just like any other rental agreement and a "performance based profit sharing" based on a formula (tied to realised CPO price over reference price less certain direct cost).

Over the years, this performance based rent has made up on average 30% of the rental income and offered a nice boost to the base rent offered on the plantation.

In fact, Boustead REIT used to make up more than 50% of my Malaysia portfolio until the recent correction of CPO price.

In Malaysia, I went a different route and chose to invest an oil palm REIT - Boustead REIT back in May 2011.

Boustead REIT is pretty unique, it's got a fixed rent, just like any other rental agreement and a "performance based profit sharing" based on a formula (tied to realised CPO price over reference price less certain direct cost).

|

| Extracted from Annual Report 2007 |

Over the years, this performance based rent has made up on average 30% of the rental income and offered a nice boost to the base rent offered on the plantation.

In fact, Boustead REIT used to make up more than 50% of my Malaysia portfolio until the recent correction of CPO price.

Going forward, with the increase CPO production both in Indonesia and Malaysia, I am not sure where the price of CPO is heading. Every plantation company seems to be talking about increase production, planting, and boasting about the size of their immature hectarage. I can certainly see the increase in supply, but the demand side is not so clear. I did not analyse the exact figure but the built up in stock figure illustrated above is a cause for concern. In the long run, labour shortage will be a cost killer for plantation. Despite all the automation, oil palm remains a very labour intensive activity.

I started closing my Boustead position back in September leaving about a quarter of my initial investment. Recently with the rebound in CPO price I did a rough computation of potential earnings rolling forward.

Rationale for estimate

Fixed rental income is pretty predictable, although some lease agreement is due for renewal next year - with potential for upward revision, I've assumed flat RM17.3M/quarter or RM69M/annum.

Performance based rent - the reference price has been moved from RM1,500 to something higher recently. Based on the last annual report, this reference price is not disclosed, the last disclosed reference price is RM 2,000 - I've assumed that this is the reference price but given the unpredictable nature of CPO price, I've assumed performance rent would be used to cover fund's overhead/interest and any remainder would be ignored as margin for error.

|

| Extracted from Annual report 2011

Based on my EPS of 11 cents and Dividend of 10 cents, I reckon the fund is fully valued. It's trading at close to 20 PE (but with little downside with growth potential) and a dividend yield of 5%. Not terribly exciting. It's trading at close to PB too.

I don't have much position left here, and would probably hold on to it given the low downside or unless I find something with a better risk adjusted return.

There's no direct comparison for this REIT, but based on MREIT data it's trading at a discount over retail REIT but premium over everything else.

That does sound pretty fair.

|

Wednesday, 9 January 2013

Herbalife - update 1

Herbalife popped to almost USD 42 (9%?) before settling back below $40s after Dan Loeb (another Hedge Funder) join this epic showdown of titans with his 8% acquisition of HLF.

|

| Today's herbalife trading chart |

- Dan Loeb's fund was one of the best performer in 2012 (Ackman's will be in a loss position after fees).

- Loeb made a successful bet on the Greeks bond market & shaped up the management team at Yahoo in 2012 (Ackman made an awful bet with JC Penney)

Loeb's fund took a 8% passive stake (cf. Ackman's 20% active short) in HLF. His reputation is stellar compared to Ackman's. While I've mentioned the other 2 hedgefund invested are relatively nobody compared to Ackman. In this case, Ackman is the relative nobody compared to Loeb.

I like the fundamental (approx. 12% FCF yield) of this company, the share tanked following Ackman's presentation - but it has increased 65% since it bottomed out @ approx $24. I don't believe it is a Ponzi scheme, I believe valuation should normalised after this battle is over.

In this long vs short battlefield, someone is going to get hurt real bad.

Currently it is trading at

Tuesday, 8 January 2013

Herbalife - MLM or ponzi scheme?

If you google for "Hedge fund porn", a few of these Herbalife article is likely to come up to the top of your search result, I just tried. It's up more 45% (@36) since the low post Ackman attack ($24.5) since last week but it's still below the traded price pre-attack.

You can get a quick summary of this hedge fund porn in this cnn article.

It's a corporate showdown likened to the Stalingrad battle.

He has shorted more than 20 millions of Herbalife's stock - that's approximately 20% of Herbalife's outstanding shares.

You can get a quick summary of this hedge fund porn in this cnn article.

It's a corporate showdown likened to the Stalingrad battle.

SHORT SIDE

On the one side, you've got Bill Ackman who in his 3.5 hours presentation on 20th December laid out his short thesis on Herbalife. He even set up a website with his facts about Herbalife. Central to his thesis is that Herbalife is a illegal ponzi scheme and is publicly betting that the stock will fall to zero.He has shorted more than 20 millions of Herbalife's stock - that's approximately 20% of Herbalife's outstanding shares.

LONG SIDE

On the long side, you've got HLF's management itself coming out swinging denying Ackman's claim. The legitimacy of the MLM model aside, they've yet to use $950 million of its authorised $1 billion buyback program due to trading restriction in current blackout period. It's got a market cap of approximately $4 billion.

Chapman Capital has since the short announcement made HLF their biggest long position staking a 35% stake of their fund. Their well structured a relatively concise rebuttal of Ackman's short thesis can be found here.

Chapman Capital has since the short announcement made HLF their biggest long position staking a 35% stake of their fund. Their well structured a relatively concise rebuttal of Ackman's short thesis can be found here.

Bronte Capital - a relative lightweight in hedgefund world also came out in support of HLF here.

Conclusion

You've got 2 diverging point of opinion and an attractively valued company. There's a lot of fear priced into the current price of HLF @ $36. Analyst are giving targets of $72 for HLF based on normalised valuation, the stock will trade pass $45 once the fear factor blows over I reckon.

It's got strong cashflow, internationalised earning and growing profitability. I seen them growing in Malaysia and do know of people consuming their product religiously.

If the government don't shut them down due to illegality - they should be easily worth a lot more. HLF's management is due to give their own rebuttal on 10th January 2013. I will be watching closely.

YTL Power - 2012 shareholding change in review.

EXECUTIVE SUMMARY

- YTL + family cumulatively disposed of 233M warrants (WB) and 24.4 M shares of YTL Power in the period between March to July 2012.

- EPF's net disposal for the year since March 2012 is approximately 13.5M shares, this pale in comparison.

- Large amount of discounted warrant (733M was offered for sale) traded since Oct has continued to weigh on the price of YTLP since trading.

- Share price has recently show some strength, coincidentally showing purchase by a director's spouse.

___________________________________________________

Since my last post, I've had the opportunity to digest various market observer's comment on the price decline of YTLP - thanks for the food for thoughts.

Case against Privatisation

Given the privatisation of YTL Cement earlier this year through a share swap and Francis Yeoh's repeated broadcast of his desire to privatise YTLP, I was suspicious about a possibility of a similar privatisation through share swap involving YTLP.However, Felicity has pointed out a very obvious fact that it is unlikely for YTL to dispose off the warrant into the market then buying it back within a short period. Yeah, they are not stupid people.

It was interesting looking at the analysis after the fact.

Price movement vs Shareholding movement

Firstly, let me apologise for the indicators on my graph - if anyone have a suggestion for a software for Mac to do a better job in editing the graph - I am all ears!

I've extracted some raw shareholding change information here.

Looking at the information extracted a few events was notable to me:

- Event A - Francis Yeoh disposed off 21 Millions share in YTLP @ approximately RM 1.83

- Event B - Between 26/3/2012 to 21/5/2012 - YTL Corp disposed off a total of 231,526,365 YTLP-WB at price range of approximately RM0.63 to RM 0.39.

- Event C - Short rebound, director and spouse disposed off 3,393,541 YTLP shares and 1,450,000 WB

- Event D - 18 Sept, offer for sale to YTL shareholder WB of YTL at RM 0.20 (61% discount to 5dwa). (Initial announcement on proposal made May 29)

- Event E - Trading of YTL post WB entitlement, reaching a support of RM1.50.

Other notable event?

- There was notice of various grants of options in August with acceptance date of option in June.

- A spouse of director has recently began acquiring YTLP shares at around RM 1.53- RM 1.59, after disposing the same share in June/July for around RM 1.76-RM1.80.

- Total disposal by EPF between 1 March 2012 to 31/12/2012 is 13,459,400 shares in YTLP. This pale in comparison with the 24 million shares and 233 million WB disposed off by YTL and family.

Conclusion

- There was an unusually large amount of disposal of warrants/share by YTL+family in the first half of 2012 that led to decline in YTLP shares/WB price.

- Subsequent to entitlement of discounted warrant by YTL shareholder on 2 Oct 2012, price of its mother share continued to decline before finding a support @ RM1.50.

- Insider has began acquiring YTLP shares at approximately RM 1.53 - RM1.59 after disposing it earlier.

Note (joke): To me the fact that a spouse of a director acquiring the share of YTLP seems to be a very Malaysia specific buy signal. (After assessing the fundamental).

Labels:

4G,

EPF,

Francis Yeoh,

Shareholding,

WB,

YTL,

YTL Power,

YTLP

Friday, 4 January 2013

YTL Power - value share or value trap?

Executive Summary

____________________________________

YTL Power's share price performance has been dismal for the last 12 months, its current price is comparable to those during the 2009 GFC. Is this valuation justified or is the share undervalued?? Is it a value share or a value trap?

- The management of YTL have a great track record in earning accretive acquisition.

- The conservation of cash is to fund growth or reduce debt

- Share is trading at a lower band of historical valuation

- Short Term pressure on price in last few months due to reduction of dividend and sale of discounted warrant likely to ease.

- Francis Yeoh thinks YTLP is undervalued and is looking to privatise it____________________________________

YTL Power's share price performance has been dismal for the last 12 months, its current price is comparable to those during the 2009 GFC. Is this valuation justified or is the share undervalued?? Is it a value share or a value trap?

Looking at the segmental level one can see that there is a considerable drag on their recent earning. In the FY ending June 2012, total loss attributable to the telecommunication startup is over RM 300 million.

Taking their most recent Q1 result and extrapolating an annualised figure to estimate their annualised earning for 2013. My expectation is for YTL Power to report an earning of approximately RM 1.3B or 0.18 cents.

A copy of the segmented spreadsheet is available here.

Based on historical Y/E PE range of 9.2 to 11.28, the expected price range would be 1.66 to 2.03. The industry segment PE according to reuters is 14.31, giving a share price of 2.58.

Based on hsitorical trading range of 10x-16x PE, YTLP's share is worth RM1.8 to RM2.88

A) Factor contributing to price decline

i) STARTUP LOSSES AT YES

As highlighted above, the operational loss attributableYTL Yes contribute to a loss of RM 307 M in the financial year ended June 2012. As of the most recent quarter the loss is RM 61 million (cf. RM 90million+ loss in Q1 2012)Based on reduction in current quarter loss, I expect the loss attributable to the telco segment to reduce to RM 242 M compared to RM 307 M in the previous year (based on a conservative annualised Q1 loss)

Bestarinet - RM 4.5 billion award

Looking at the revenue increase for the YES segment, one can imply an increase in take-up for the product by the end user. The boost offered to the segment by the 1Bestarinet contract valued at RM 4.5 billion is also expected to help cushion against losses in this segment.

LTE?

Other catalyst for the reduction of loss in this segment could be the implementation of LTE on YTL's network. Currently YTL operates its YES network on the WIMAX spectrum. In the technology war for the 4th Generation network, it appears that WIMAX is losing. The biggest supporter of WIMAX is Sprint Nextel, and they are getting rid of WiMax and switching everything over to LTE. Francis Yeoh has conceded the willingness of Yes to roll out the LTE network. Based on other quotes attributable to YES' management, it appear that their is ready for LTE too. P1, whose network operates on WIMAX, demonstrated a live Wimax-LTE TDD network to media during a demonstration in April 2011. YTL operates with the same technology on the same spectrum.

Based on my understanding, the demonstration by P1 illustrate that it is possible based on current technology to have both LTE and WIMAX on the LTE TDD spectrum currently utilised by YTLP. This technology will allow switching between WIMAX and LTE just like current switch between EDGE and 3G.

Hence the current early adoption of Wimax by YTL won't impede their ability to later transition to LTE (technology being adopted by Digi, Maxis and Celcom) but would rather allow them to switch their LTE network on at a time when they have coverage competitive with the major telco.

Currently Maxis and Digi have an approximate market capitalisation of RM 52 Billion and RM 41 Billion respectively. YTL Power have a market cap of RM 12 B. Ponder on that.

(Yes, Greenpacket have a measly market cap of RM 318 million. But they don't have the financial strength to built up a network that's competitive to the major telco and I think YTL's track record in executing engineering job shows that they have proven execution history.

It is not that unthinkable that with a competitive network, YTLP will gain a sizeable slice of the telco pie from the incumbent thereby creating a new cashflow stream for shareholder willing to invest in this growth story.

The current discount to YTLP's valuation due to the start-up loss will not continue indefinitely. On a worst case scenario, YTLP can discontinue its telco network (thereby stopping the operational losses) and sell its asset (including mobile spectrum).

ii) DIVIDEND PAYOUT REDUCTION

Dividend has been reduced to 0.9375 cents/share (3.75 cents annualised) in its latest quarter from a 4 year historical average (2008-2011) of 12.69 cents (based on financial highlight extracted from its annual report above).

Based on historical financial statement and analyst forecast, it is not disputed that YTLP's stable of asset has a track record in cash generation ability. The reduced dividend payout is a management decision and not forced upon them by their inability to generate cash.

YES

Already ongoing, but yet the cash pile is growing.

Train to Singapore?

Long shot. YTL have been dreaming about this rapid train service since 2006. A preliminary costing of RM 8 billion was then provided by YTL. It has been reported that a feasibility study is being conducted by SPAD and the report will be submitted to the government in Q1 2013.

Based on historical financial statement and analyst forecast, it is not disputed that YTLP's stable of asset has a track record in cash generation ability. The reduced dividend payout is a management decision and not forced upon them by their inability to generate cash.

Currently YTLP despite its investment into YES, managed to increase its cash pile to over RM 10 Billion (as at Sept 2012). Analyst believe that the management is conserving the cash for more M&A opportunity.

As outsider, we are unable to ascertain what is the true intention of the management in conserving the cash.

However, YTLP was previously known to be a reliable dividend counter, having changed its payout outlook, investor with preference for dividend yielding stock would have been abandoning the stock in drove, further contributing to the price decline.

However, for investors with a longer time horizon and a growth focus. The conservation of cash by YTLP for M&A is a positive growth signal given their track record for earning accretive acquisition.

Potential target for cash utilisation by YTLP? - (purely speculative)

In Dec 2010, YTLP announced a JV with Eesti Energia of Jordan to jointly develop an oil shale project in Jordan. The total project cost is US$5 billion and YTLP have a 30% stake in the JV.

The total exploration and production rights under this concession agreement gives a 40+10 years exploration and production right to 2.3 billion tons of oil shale.

There don't seem to be much update on this Jordanian project since but based on the information available on the partner's website it appear that the project is ongoing. The first operational phase of the project will be a Oil Shale Fired Power Plant for 460W to be operational by 2016 - see recent news.

Already ongoing, but yet the cash pile is growing.

Train to Singapore?

Long shot. YTL have been dreaming about this rapid train service since 2006. A preliminary costing of RM 8 billion was then provided by YTL. It has been reported that a feasibility study is being conducted by SPAD and the report will be submitted to the government in Q1 2013.

No guarantee that the project will be given the green light and even if it does whether YTLP will have a position in the consortium to develop the project. However given the closer G2G relationship between Singapore and Malaysia in recent time, it is certainly possible and since YTL have a proven track record in managing/executing the ERL project - they will be given a seat on the project.

iii) SALE OF WARRANT TO YTL SHAREHOLDER @ RM 0.20 (RM1.21 CONVERSION PRICE)

- In the 3 months prior to the announcement of warrant entitlement, YTLP shares was trading at a range between RM 1.70 to RM1.82.

- On 18 Sept 2013 YTL announced an offer to sell up to 733,079,172 warrants in YTLP to its existing shareholder at a 61% discount to the 5 days weighted average market price of RM 0.513.

- The entitlement date is 2 October 2012.

- In the 3 months since grant of warrant to YTL's shareholder, the share price of YTLP fell to a low of RM1.50 finding support.

- The conversion price of the warrant is RM1.21 on a 1:1 ratio.

- The sudden supply of discounted warrant will place a downward pressure on the price of its mother share even without any change in its operational outlook.

IV) INDEPENDENT POWER PRODUCER EXPIRY

The PPA is likely to expire in 2015. So far, YTLP has been unsuccessful in its bid for any of the new PPA and even if it succeed, the terms are likely to be less favourable than it is now.

Based on my 2013 earning estimate of RM 200 million, the discontinued earning from the PPA in 2015 is likely to be offset by reduction in losses by the telco segment.

B) Potential catalyst?

Other than those highlighted in discussion above (reduce losses from YES, Jordan, M&A), another obvious catalyst for YTLP would be its exposure to GBP.

Revisiting the segmented earning result above, it would have been clear that Wessex concession's earning contribution has been declining over the last few years (approximately 20%). At the same time GBP has fallen from 35% since 2008.

CONCLUSION

- The management of YTL have a great track record in earning accretive acquisition.

- The conservation of cash is to fund growth or reduce debt

- Share is trading at a lower band of historical valuation

- Short Term pressure on price in last few months due to reduction of dividend and sale of discounted warrant likely to ease.

- Francis Yeoh thinks YTLP is undervalued and is looking to privatise it -

Given Yes' potential to be a full fledge telco, it should be given a higher PE given its growth potential.

If I were a conspiracy theorist, I would believe the reduction in dividend and the flooding of cheap warrants is an attempt by the management to push lower the price to allow for a cheaper privatisation! However, given the religious nature of its management, I would doubt they will resort to such unethical tactic to defraud the average retail investor.

Subscribe to:

Comments (Atom)